There’s a new tariff in town

By Joseph Sevick, Research Director at Wood Mackenzie

General Film Flexibles Plastic China Tariffs Polyethylene Market propane and chemicals market PVC Market U.S tariffs Verisk Analytics Wood MackenzieChina retaliates against propane and petrochemicals - a look at the proposed 25 percent tariffs on a wide array of US products.

On April 4, 2018, China fired a retaliatory salvo in the mounting U.S. trade war. China proposed additional 25 percent tariffs on 106 products, ranging from cars to agricultural products to chemicals. China targeted $50-billion worth of U.S. exports, striking back against rising U.S. protectionism.

Two days ago, only pork products received the maximum 25 percent tariff level. Today 44 products related to chemicals or energy were put on notice with propane, polyethylene, and PVC (polyvinyl chloride) garnering the biggest headlines in the chemicals space.

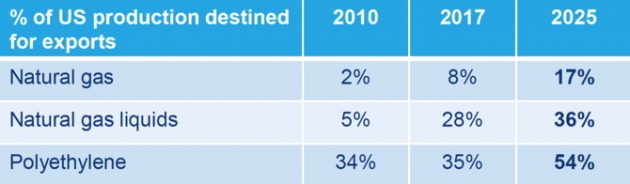

The shale gas renaissance has revitalized the North American natural gas liquid and petrochemical industry. From 2015 to 2025, we expect $50-billion of NGL (natural gas related)-related investment and $100-billion of petrochemical investment. Much of this capital is geared towards the export market as seen in the table below:

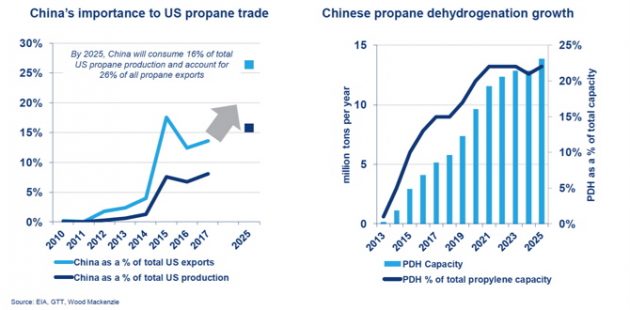

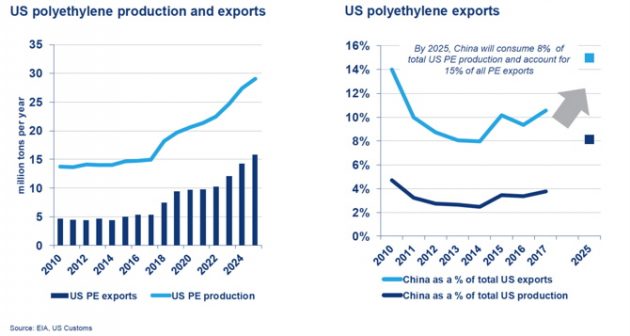

China imported eight percent of U.S. propane production last year, and only imported five percent of U.S. polyethylene and PVC production. The reliance on China expands through 2025, especially in propane as China propane dehydrogenation capacity undergoes a second capacity “wave” in 2019-2021. U.S. producers could manage a short-term tariff via alternative logistics or directing flows to Europe, but a lasting tariff would threaten the next wave of export-based petrochemical investments.

How Did It Happen?

Source: ABC News

During the presidential campaign, then-candidate Trump frequently criticized China on the campaign stump: “They’re ripping us left and right. Just take them to McDonald’s and go back to the negotiating table.” – July 21, 2015.

“China is neither an ally or a friend-they want to beat us and own our country.” – Sept. 21, 2011

In 2017, President Trump launches investigations into unfair foreign steel practices and Chinese intellectual property theft.

January 2018 – Trump levies tariffs on solar panels and washing machines, primarily affecting China, South Korea, and Mexico.

March 2018 – The U.S. imposes 25 percent steel tariffs and 10 percent aluminum tariffs on all countries. Eventually NAFTA, EU, and several other countries were declared exempt from the tariff, leaving China as the primary target.

April 2, 2018 – China responds for the first time, imposing tariffs on $3-billionn of U.S. imports.

April 3, 2018 – President Trump escalates the trade war by proposing tariffs on 1,300 Chinese goods worth $50-billion as punishment for intellectual property theft.

April4, 2018 – Declaring that “it is only polite to reciprocate”, China matches the U.S.’s $50-billion target and proposes 25 percent tariffs on a wide array of U.S. products. Many target Trump’s voter base, such as pork and soybeans from the Midwest and whiskey from Kentucky. Texas is also staunchly Republican, leading to propane and petrochemicals making the list.

How Important Is China To The Propane And Chemicals Market?

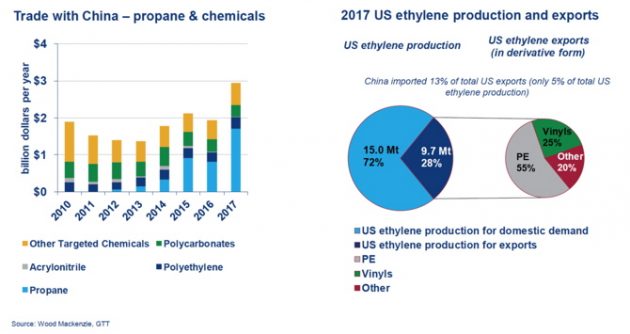

China imported $3-billion of propane and chemicals targeted in the latest tariff proposal. Propane accounted for 60 percent of 2017’s value and is the only growing sector since 2010. Propane exports felt shale’s impact sooner than petrochemicals, since it takes 5-7 years to build a new petrochemical complex. This will all change starting in 2018 as first wave of new petrochemical capacity reaches full production.

How Important Is China To The Propane Market?

In 2017, China imported 123,000 b/d of propane from the US worth $1.7-billion. China is the U.S.’s third-largest propane importer after Japan and Mexico. China lowered the previous tariff to one percent because China’s PDH capacity is surging. PDH operation prefers high-purity HD2 grade propane that U.S. exporters specialize in and is not easily backfilled by other sources. If the 25 percent tariff comes to fruition, U.S. propane exporters could target lower-valued European steamcracker demand.

How Important Is China To The Polyethylene Market?

The U.S. was China’s sixth-largest PE source in 2017, behind several Middle Eastern and Asian countries. From 2018 to 2025, exports grow nearly 1.5 mtpa as long-awaited ethane-based investments come online. Ethane currently has a $400/ton advantage versus Asian naphtha cracking. The 25 percent tariffs would primarily affect LDPE (Low-density polyethylene) and LLDPE (Linear low-density polyethylene), requiring repositioning between the U.S., Middle East, and Europe but U.S. producers could still supply Chinese markets via local JVs.

How Important Is China To The PVC Market?

How Important Is China To The PVC Market?

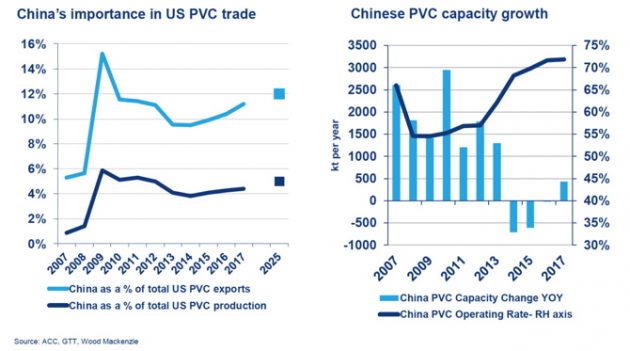

In 2007, shale economics and the domestic housing collapse led to a shift upward in the importance of PVC exports to U.S. producers. China, meanwhile, was adding massive domestic PVC capacity. Today, almost 40 percent of U.S. PVC goes offshore and future expansions target additional export volumes. China is a key trade partner, absorbing around 11 percent of all U.S. PVC exports. EDC is tariff targeted also, so the potential impact on the full chain is actually greater.

Conclusion

China’s tariff announcement was met with assurances from President Trump that we are not in a trade war. Trump’s National Economic Council director has already dialed back the tension, insisting tariffs may not take effect and could be a negotiating tactic.

If China actually levies these additional 25 percent tariffs against US products, we expect the following to occur:

- Propane – The initial effect on U.S. propane exports would be minimal, as it would take time for China to source backup propane. The U.S. is the largest propane exporter in the world and is the primary propane growth engine in the world, especially when OPEC curtails oil production. Propane prices rose substantially last year when U.S. production growth underwhelmed, requiring the cancellation of multiple U.S. propane export cargoes. Longer term, the U.S. would target European steamcracker and PDH demand while China dominates Middle Eastern cargoes;

- Polyethylene and other ethylene derivatives – if the tariff goes through, Middle Eastern producers would be the incremental polyethylene supplier to China. Middle Eastern volumes allocated to Europe or Africa would face increasing competition from U.S. material. But if U.S. producers had to target China, U.S. netbacks could fall $200/ton.

Wood Mackenzie, a Verisk Analytics business, is a trusted source of commercial intelligence for the world’s natural resources sector. It empower clients to make better strategic decisions, providing objective analysis and advice on assets, companies and markets. For more information visit: www.woodmac.com.

Advertisement